Securitization is a low-cost financing method whereby utilities receive immediate payments for incurred expenses, while customers pay back the securitized amounts over an extended period through a surcharge on bills.

________________________________________________

On June 30, gas utilities across Texas filed for regulatory permission to charge their customers more than $3.6 billion in incremental gas costs incurred during Winter Storm Uri. Under the applications, the utilities would employ a unique form of financing known as “securitization” to receive the reimbursements, which then would be combined and collected (with interest) and charged to customers statewide for two to three decades.

On June 30, gas utilities across Texas filed for regulatory permission to charge their customers more than $3.6 billion in incremental gas costs incurred during Winter Storm Uri. Under the applications, the utilities would employ a unique form of financing known as “securitization” to receive the reimbursements, which then would be combined and collected (with interest) and charged to customers statewide for two to three decades.

BACKGROUND

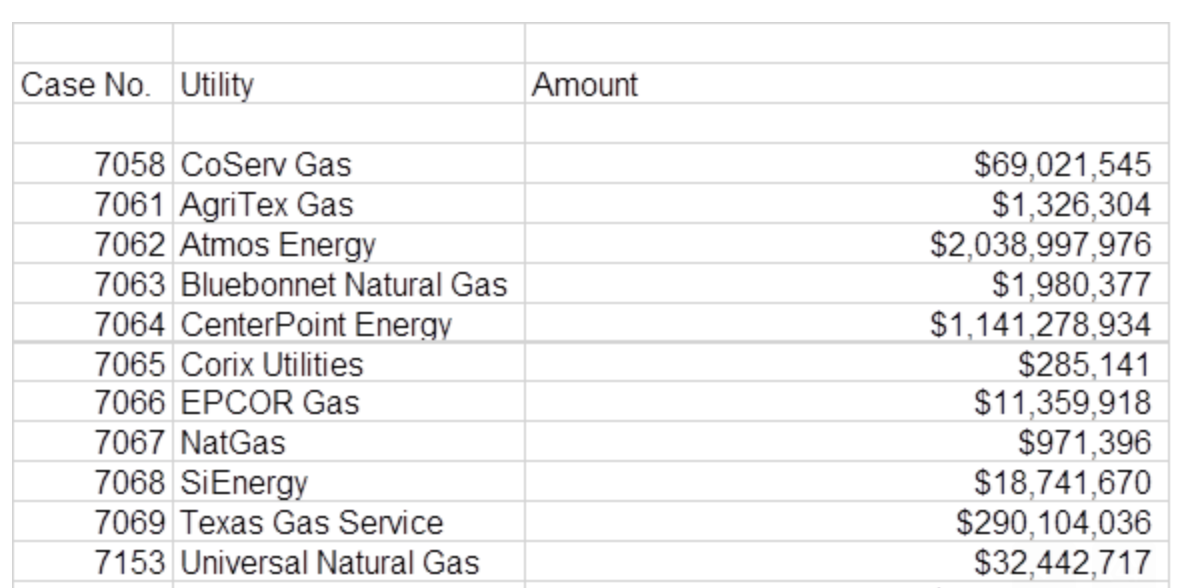

As shown on the attached chart, Atmos, the state’s largest gas utility, is seeking more than $2 billion through the securitization process. CenterPoint Energy that owns the state’s second largest gas utility seeks more than $1.1 billion. What explains these regulatory requests? During last February’s winter storm, gas prices rose from about $3 per million British Thermal Units to approximately $400/MMBtu. This resulted in a massive jump in gas expenses incurred by Atmos, CenterPoint and other gas utilities. Ordinarily, utilities would pass such expenses promptly onto their customers. However, in order to stave off what would have been substantial rate shock, the Texas Railroad Commission directed utilities instead to log these incremental gas costs on their books as “regulatory assets” to be dealt with later. Then, in May, the Texas Legislature adopted House Bill 1520 authorizing utilities to seek securitization of those amounts.

SECURITIZATION REQUESTS BY UTILITY

Securitization is a low-cost financing method whereby utilities receive immediate payments for incurred expenses, while customers pay back the securitized amounts over an extended period through a surcharge on bills. Under HB 1520, the Commission has 150 days to review the requested securitization amounts and determine how much may be collected from customers. As shown in the chart, nearly a dozen gas service providers have filed for securitization financing, and the RRC has decided to combine all those applications into a single proceeding.

This is the first such proceeding ever considered at the Railroad Commission, and the agency’s three elected commissioners have decided to preside over it themselves. We’ll keep you updated as the case proceeds.