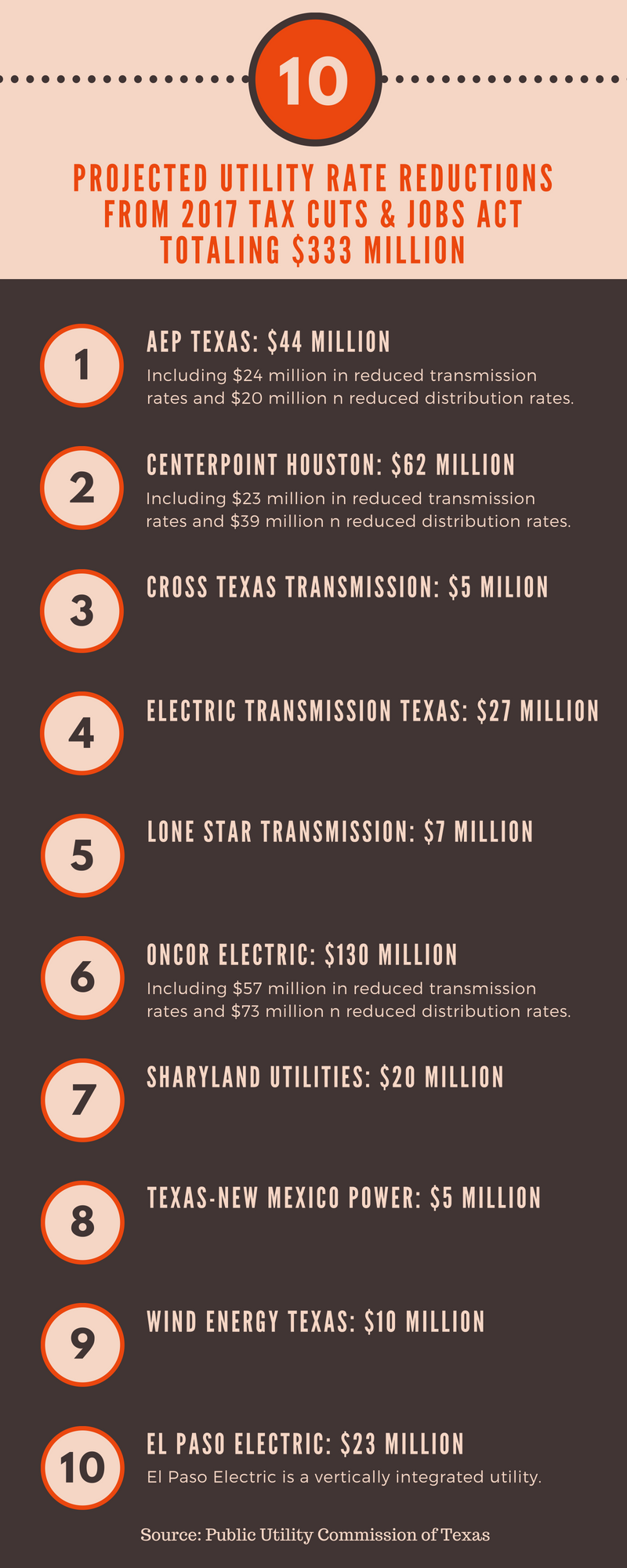

One-third of a billion dollars — that’s the value of rate reductions so far approved by Texas electric utility regulators as a consequence of the 2017 Tax Cuts and Jobs Act.

Adopted last December, the federal tax law reduced corporate liability from 35 percent to 21 percent. The Texas Public Utility Commission in response has called upon the state’s electric utilities to reduce their rates, and a new staff memo filed this week outlines the reductions so far. You can read the memo here.

As with tax issues generally, the details are daunting. The state’s utilities availed themselves of highly technical PUC rules to implement the reductions — distribution cost recovery factors, interim transmission cost-of-service filings, various forms of credit riders — and city groups have intervened in many of the complex cases to safeguard consumer interests. Among those city groups is the Steering Committee of Cities Served by Oncor.

In areas of Texas with retail electric deregulation the savings will NOT go directly to residential and business electricity customers, but rather flow first through retail electric providers. These REPs serve end-use customers and have wide discretion under the Texas deregulation law to charge whatever they want. Consumer groups and media watchdogs have urged REPs to pass along the savings, and at least one lawmaker has warned of regulatory action if they fail to do so.

The chart at the bottom of this post summarizes the total value of the reductions so far authorized by the PUC, as detailed in the Aug. 23 staff memo to the PUC’s three commissioners. Staff noted that the agency now has adopted rate reductions for the majority of the state’s electric utilities, although still pending are decisions for Southwestern Electric Power Company, Southwestern Public Service Company and Entergy Texas.